Cañariaco

Cañariaco is a 100% owned porphyry copper project within a prolific trend of producing mines and known deposits in northern Peru.

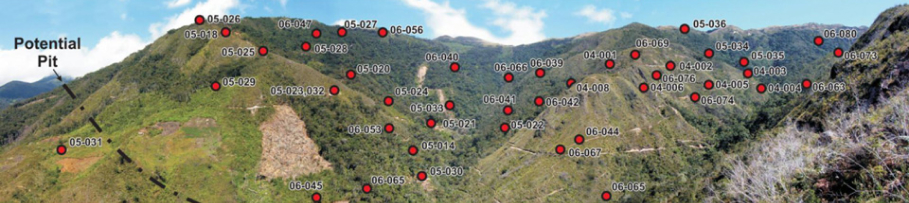

Cañariaco Norte, Cañariaco Sur and Quebrada Verde are all part of the Cañariaco Project and occur within a trend over five kilometres in length. Geological mapping, geophysics and geochemical sampling by Alta Copper, and by Billiton in 1999 (including limited drilling), indicate a strong potential for additional porphyry copper-gold mineralization within the complex.

Cañariaco Norte

A Large Scale Copper Project in Peru

Since 2004, Alta Copper has drilled more than 85,000m in 289 drill holes at Cañariaco Norte to define a 9.3B pounds Measured and Indicated Resource, plus 2.7B pounds Inferred Porphyry Copper Deposit, with excellent expansion potential through, Cañariaco Sur, which has an initial Inferred Resource of 2.2B pounds of copper, 1.2M ounces of gold and 15.0M ounces of silver and the Quebrada Verde target. Cañariaco Norte also contains a Measured and Indicated Resource of 2.14M ounces of gold and 59.43M ounces of silver plus an additional Inferred Resource of 0.54M ounces of gold and 18.09M ounces of silver.

(see in details Resource Tables below)

2024 PEA – Summary of Economic Results

AFTER-TAX (US$M, Unless Otherwise Stated)

| Cu Price (US$/lb) |

3.50 |

3.85 |

4.00 |

4.50 |

5.00 |

| Undiscounted After-Tax Cash Flow (LOM) |

5,887 |

7,572 |

8,293 |

10,677 |

13,055 |

| Net Present Value (8%) |

1,450 |

2,054 |

2,312 |

3,163 |

4,011 |

| IRR (%) |

18.7 |

22.5 |

24.1 |

28.9 |

33.4 |

| Average Annual Revenue (US$M) |

1,118 |

1,217 |

1,259 |

1,401 |

1,542 |

| Average Annual EBITA |

463 |

561 |

604 |

744 |

885 |

| Average Annual Free Cash Flow (Note 3) |

295 |

356 |

383 |

470 |

557 |

| Average Annual Free Cash Flow (Year 1-10) (Note 3) |

437 |

508 |

538 |

638 |

739 |

| Payback Period (Note 3) |

3.7 |

3.2 |

3.1 |

2.6 |

2.3 |

PRE-TAX (US$M, Unless Otherwise Stated)

| Undiscounted Pre-Tax Cash Flow (LOM) |

9,746 |

12,433 |

13,585 |

17,424 |

21,264 |

| Net Present Value (8%) |

2,735 |

3,701 |

4,115 |

5,496 |

6,876 |

| IRR (%) |

25.3 |

30.3 |

32.4 |

39.0 |

45.1 |

| Mill Throughput |

120,000 tpd |

||||

| Average Annual Cu Production (Year 1 to 10) |

347 million lbs Cu | 158K tonne Cu |

||||

| Average Annual Cu Production (LOM) |

294 million lbs Cu | 134K tonne Cu |

||||

| C-1 Cash Costs (net of by-products) $/lb |

1.86 |

||||

| AISC (Note 5) $/lb |

1.96 |

||||

| Strip Ratio (Waste to Ore) |

1.33 to 1 |

||||

| Initial Mine Life (Years) |

27 |

||||

| Initial Project Capital |

2,160 |

||||

| Sustaining Capital |

526 |

||||

| Closure Cost |

216 |

||||

Notes

(1) Copper contributes 88% of the net revenue with the balance of 12% from gold silver credits in copper concentrate.

(2) For this analysis Gold is US$1,850/oz and Sliver is US$23/oz and remain constant with only the Copper price changing.

(3) From Commencement of Operations.

(4) Cash Costs consist of mining, processing, site G&A, off-site treatment and refining, transport, and royalties net of by-product

credits (Au & Ag).

(5) AISC consists of Cash Costs plus sustaining capital and closure costs.

Cañariaco Norte Mineral Resource Estimate (0.15% Copper Cut-off Grade)

| Contained Metal | ||||||||

| Resource Classification | tonnes (Mt) |

Cu Eq (%) |

Cu (%) |

Au (g/t) |

Ag (g/t) |

Copper (B lbs) |

Gold (M Ozs) |

Silver (M Ozs) |

| Measured | 423.5 | 0.48 | 0.43 | 0.07 | 1.9 | 4.04 | 0.98 | 25.71 |

| Indicated | 670.7 | 0.39 | 0.36 | 0.05 | 1.6 | 5.25 | 1.16 | 33.72 |

| Measured+ Indicated | 1,094.2 | 0.42 | 0.39 | 0.06 | 1.7 | 9.29 | 2.14 | 59.43 |

| Inferred | 410.6 | 0.32 | 0.29 | 0.04 | 1.4 | 2.66 | 0.55 | 18.09 |

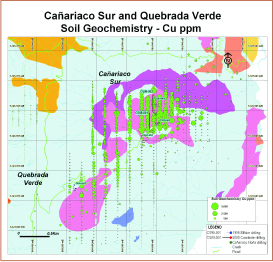

Cañariaco Sur and Quebrada Verde

Cañariaco Sur is the second copper-gold porphyry intrusive body discovered to date on the Cañariaco Property and lies 1.3 km south of the centre of the Cañariaco Norte deposit. The close proximity of Cañariaco Sur to Cañariaco Norte, offers the potential to add significantly to the economics of the Cañariaco project through shared infrastructure and facilities.

In January 2022, an Initial Inferred Mineral Resource was estimated for the portion of the Cañariaco Sur deposit drilled to date. This Inferred Resource contains 2.2 billion pounds of copper, 1.2 million ounces of gold and 15.0 million ounces of silver. This deposit contains higher levels of gold and molybdenum than Cañariaco Norte, minimal arsenic levels and mineralization that starts at surface. This Initial Resource estimate is based on 15 drill holes on the eastern portion of a large geochemical anomaly which extends several hundred metres to the west and southwest. Higher grade phyllic style copper-gold mineralization was intersected in the western-most hole drilled to date.

Cañariaco Sur Initial Inferred Resource (0.15% Copper Cut-off Grade)

| Contained Metal | ||||||||||

| Cut-Off | Tonnes | Cu Eq* | Cu (%) | Au | Ag | Mo | Copper | Gold | Silver | Molybdenum |

| Grade Cu (%) | (M) | (g/t) | (g/t) | (ppm) | (B lbs) | (M Ozs) | (M Ozs) | ( M lbs) | ||

| 0.1 | 433.2 | 0.3 | 0.25 | 0.09 | 1.2 | 22 | 2.36 | 1.26 | 16.39 | 20.88 |

| 0.15 | 384.5 | 0.32 | 0.26 | 0.10 | 1.2 | 22 | 2.22 | 1.18 | 15.02 | 18.91 |

| 0.2 | 290.0 | 0.35 | 0.29 | 0.11 | 1.3 | 22 | 1.85 | 0.98 | 11.88 | 14.25 |

- The Mineral Resources have an effective date of January 27, 2022. The Qualified Person for the estimate is David Thomas of DKT Geosolutions Inc.

- The Mineral Resources were estimated in accordance with the Canadian Institute of Mining and Metallurgy (“CIM”) Definition Standards (2014) and the CIM “Estimation of Mineral Resources and Mineral Reserves Best Practice” (2019) guidelines;

- A single 0.1% Cu grade shell domain was constructed using implicit modelling

- Raw drill hole assays were composited to 15 m lengths broken at domain boundaries.

- Capping of high grades was considered necessary and was completed on assays prior to compositing. Copper assays were capped to a 0.8% threshold and gold assays were capped at a threshold of 1 g/t.

- Block grades for gold were estimated from the composites using ordinary kriging interpolation into 20 x 20 x 15 m blocks coded by the 0.1% Cu grade shell .

- The mineral resource is reported above a 0.15% Cu cut-off grade. Additional cut-off grades are shown for sensitivity purposes only.

- A dry bulk density of 2.5 g/cm3 was used for all material.

- The Mineral Resources are reported within a constraining Lerchs Grossmann pit shell developed using Hexagon’s MinePlan 3D™ software using:

- A copper price of US$3.50/lb

- Mining cost of US$1.60/t;

- An combined processing, tailings management and G&A cost of US$6.52/t;

- 45 degree Pit slope angles;

- A copper process recovery of 88%.

- Copper concentrate smelter terms: US$75/DMT TC, US$0.075/lb RC and 96.2% payable

- Estimated concentrate shipping costs of US$133.00/WMT of concentrate

- Copper equivalent grades including contributions from gold, silver and molybdenum, were estimated using metal prices (copper US$3.50 /lb, gold US$1, 650 /oz, US$21.5 /oz and US$11.00/lb Mo), metal recoveries (copper 88%, gold 65%; silver 57% and molybdenum 60%) and smelter payables (copper 96.5%: gold 93%; silver 90% and molybdenum 100%). Copper grade equivalent calculation: Cu Eq% = Cu % + ((Au grade x Au price x Au recovery x Au smelter payable%) + (Ag grade x Ag price x Ag recovery x Ag smelter payable%)+ (Mo grade x Mo price x Mo recovery x Mo smelter payable%))/(22.0462 x Cu price x 31.1035 g/t x Cu recovery x Cu smelter payable%).

- There is no metallurgical testwork on Cañariaco Sur at this time – Cañariaco Norte average recoveries have been applied for LG shell generation and Copper equivalent estimations.

- All figures are rounded to reflect the relative accuracy of the estimate. Totals may not sum due to rounding as required by reporting guidelines.

- The contained metal figures shown are in situ. No assurance can be given that the estimated quantities will be produced.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

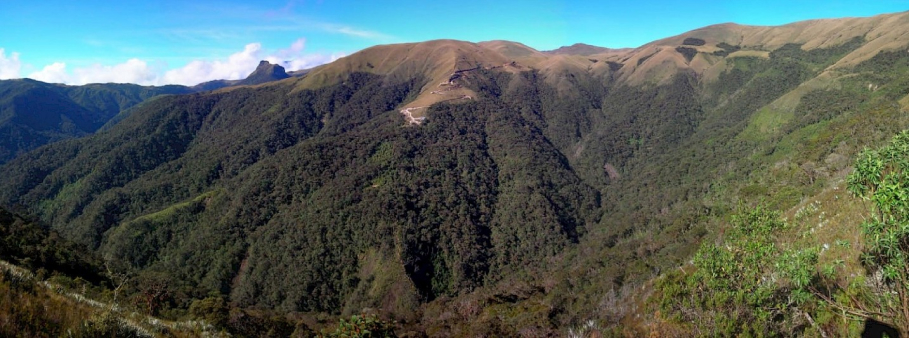

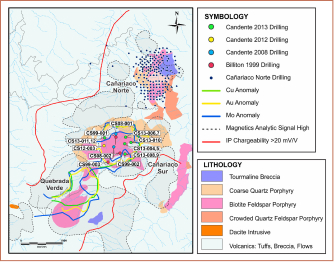

Cañariaco Norte, Cañariaco Sur and a third target, Quebrada Verde, are part of an extensive porphyry complex covering a minimum length of five kilometres and an average width of two kilometres. The porphyry complex is covered entirely by the Cañariaco property, which is held 100% by Alta Copper. Geological mapping, geophysics and geochemical sampling by Alta Copper, and by Billiton in 1999 (including limited drilling), indicate a strong potential for additional porphyry copper-gold mineralization within the complex.

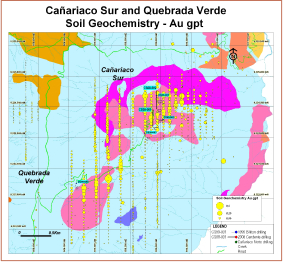

In the Quebrada Verde area, recent geophysical surveys have delineated a large IP chargeability high centered on a resistivity anomaly and covering an area of 0.8 km by 2.0 km. Argillic and minor phyllic alteration occur in biotite-feldspar porphyry intrusive similar to that which hosts the bulk of the copper mineralization at the Cañariaco Norte deposit. A magnetic high could represent potassic alteration at depth. In addition, anomalous levels of copper of up to 2,200 ppm (0.22%) and up to 497 ppb gold in soils cover an area of approximately 0.7 by 0.9 kilometres. The geochemical anomalies at Cañariaco Sur and Quebrada Verde are much stronger than those occurring in soils at Cañariaco Norte indicating a thinner leached cap. Volcanic host rocks are believed to be masking lateral surface expression of the Cañariaco Sur and Quebrada Verde porphyry intrusive as they do over parts of the Cañariaco Norte deposit.

The Cañariaco Sur and Quebrada Verde area is underlined by Calipuy volcanic sequence intruded by several phases of porphyry and locally tourmaline breccias. Calipuy volcanics consist mainly of lavas and piroclastics. Intrusives are of granodiorite composition and they vary from biotite rich (quartz diorite porphyry) to Quartz “eye” rich (quartz monzonite porphyry, quartz feldspar porphyry). Tourmaline breccias similar to those seen at Cañariaco Norte have been mapped along the margins of the porphyry intrusives.

Maps

Regional Geology

{click to enlarge)

Soil Geochemistry - Gold

{click to enlarge)

Soil Geochemistry - Copper

{click to enlarge)